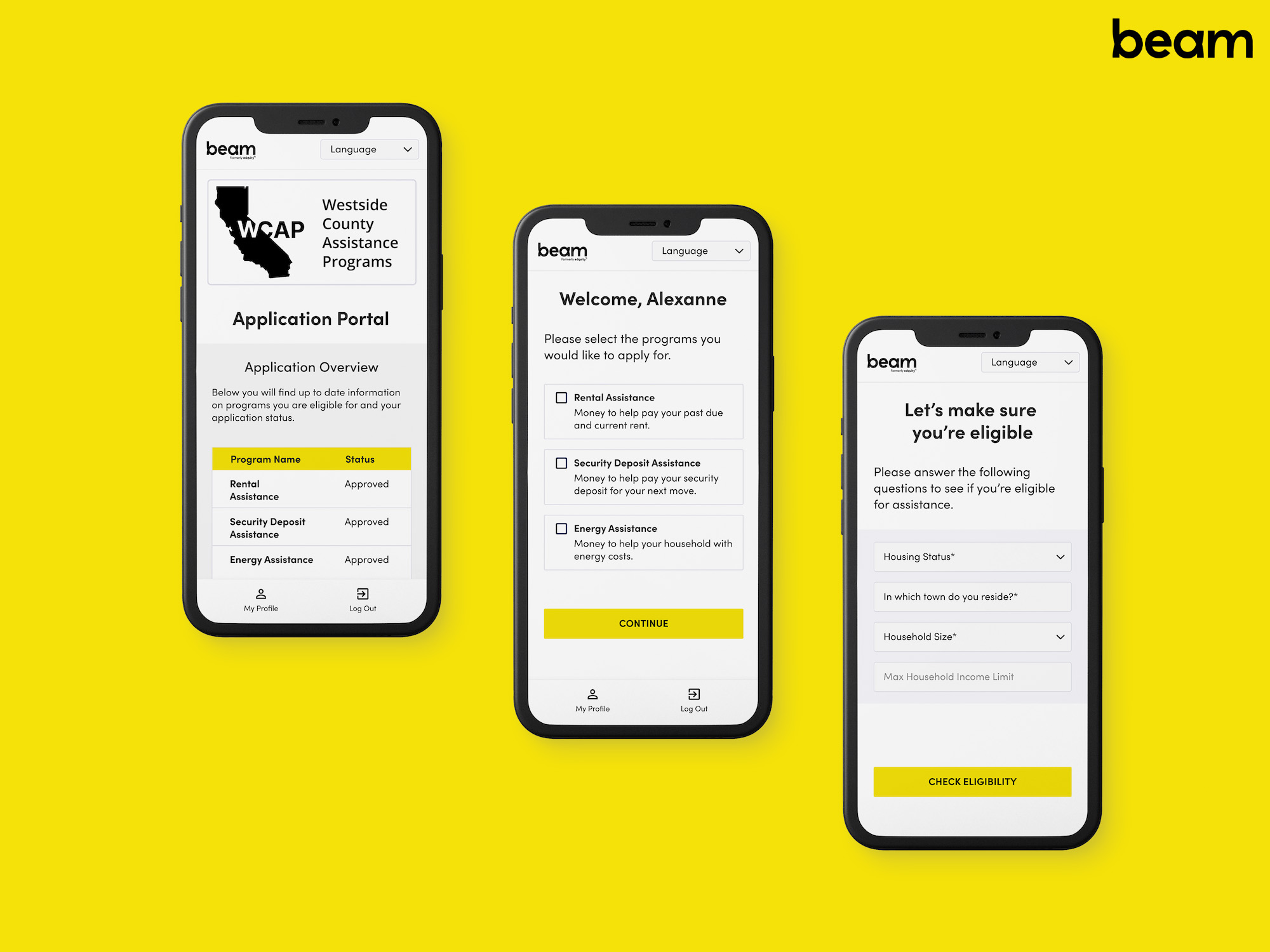

Power programs with speed, equity, and simplicity.

Administering programs is complex. Beam can help. Beam, formerly Edquity, simplifies program administration so that everyone—case managers, funders, and applicants—can thrive.

With Beam:

With Beam:

Applications are no longer inherently biased

Administration burden is lifted

Applicants receive answers in hours

Funds are securely claimed within days

Program insights are transparent

Regulatory compliance and reporting are built right in